- Knowledge Base

- Asset Sales vs. Stock Sales in Dentistry: Which is the Better Choice for Your Practice?

Asset Sales vs. Stock Sales in Dentistry: Which is the Better Choice for Your Practice?

Leslie George

2025-06-3

10 mins

Share

Asset Sales vs. Stock Sales in Dentistry: Which is the Better Choice for Your Practice?

Deciding to sell your dental practice is a significant milestone, but it can also be a daunting decision. With two primary avenues—asset sales and stock sales—understanding which option best serves your goals is crucial. Each choice presents unique advantages and challenges that can impact not just the sale process, but also your financial future. Asset sales typically allow for a smoother transition of individual components like equipment and patient lists, while stock sales may offer a simpler transfer of ownership with potential tax benefits. As you navigate these pathways, weighing factors such as tax implications, potential liabilities, and the long-term vision for your practice becomes essential. In this article, we’ll explore the pros and cons of each approach, equipping you with the insights needed to make an informed decision that aligns with your personal and professional aspirations. Whether you're looking to maximize value or ensure seamless continuity, understanding these differences is your key to a successful transition.

Understanding Asset Sales in Dentistry

When considering the sale of a dental practice, asset sales are one of the most common and preferred methods. An asset sale involves selling individual assets of the practice rather than the entire entity. These assets can include tangible items such as dental equipment, office furniture, and supplies, as well as intangible assets like patient lists, goodwill, and trademarks. This type of sale allows the buyer to pick and choose which assets they want to acquire, giving them flexibility and control over their investment. Asset sales are particularly advantageous for buyers who are looking to avoid inheriting any of the seller's liabilities. Since the transaction focuses on specific assets rather than the entire entity, the buyer is not responsible for any existing debts or legal issues associated with the practice. This can be a significant advantage, especially if the seller’s practice has any outstanding loans or pending legal matters. For sellers, this means they can negotiate the sale of assets they no longer need while retaining control over the rest of the practice. Another benefit of asset sales is the potential for a smoother transition. Buyers can gradually integrate the acquired assets into their existing practice, ensuring minimal disruption to their operations. Sellers can also provide training and support for the specific assets being transferred, facilitating a seamless handover. This approach can be particularly beneficial when transferring patient lists and ensuring continuity of care. Overall, asset sales offer a practical and flexible solution for both buyers and sellers in the dental industry.

Understanding Stock Sales in Dentistry

Stock sales, on the other hand, involve the sale of the entire entity, including all its assets and liabilities. In this type of transaction, the buyer purchases the seller's shares in the corporation, effectively taking over the entire practice. This means the buyer inherits everything associated with the practice, including its debts, contracts, and legal obligations. While this may seem daunting, stock sales can offer several advantages that make them an attractive option for both buyers and sellers. One of the key benefits of stock sales is the simplicity of the transaction. Since the buyer is acquiring the entire entity, there is no need to itemize individual assets or negotiate separate agreements for each asset. This can streamline the sale process and reduce the time and effort required to complete the transaction. For sellers, this means they can quickly and efficiently transfer ownership of their practice without the need for extensive documentation and negotiations. Stock sales can also provide significant tax benefits for both parties. Because the buyer is acquiring the entire entity, they may be eligible for certain tax deductions and credits that are not available in asset sales. For sellers, stock sales can result in lower capital gains taxes, as the sale of shares is typically taxed at a lower rate than the sale of individual assets. These tax advantages can make stock sales an appealing option for dental practice owners looking to maximize their financial gains.

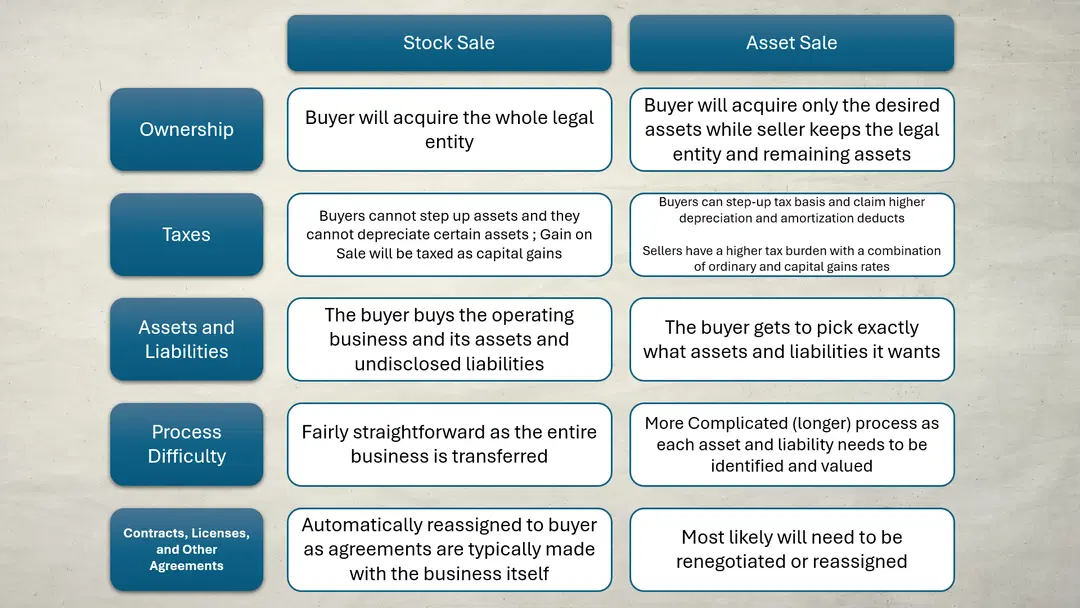

Key Differences Between Asset Sales and Stock Sales

Understanding the key differences between asset sales and stock sales is crucial for dental practice owners considering selling their practice. One of the main distinctions is the scope of the transaction. In an asset sale, only specific assets are transferred, while in a stock sale, the entire entity is sold. This difference has significant implications for both buyers and sellers, affecting everything from liabilities to tax treatment. Liabilities are a major consideration in dental practice sales. In asset sales, buyers can avoid inheriting the seller's liabilities by selectively purchasing assets. This means they are not responsible for any existing debts or legal issues associated with the practice. In contrast, stock sales involve the transfer of the entire entity, including all its liabilities. This means buyers must assume responsibility for any outstanding debts, contracts, and legal obligations. Sellers must be prepared to disclose all liabilities and ensure the buyer is fully aware of what they are inheriting. Tax treatment is another important difference between asset sales and stock sales. Asset sales typically result in higher tax liabilities for sellers, as the sale of individual assets can be subject to ordinary income tax rates. However, buyers may benefit from depreciation deductions and other tax advantages associated with the acquired assets. Stock sales, on the other hand, can offer lower capital gains taxes for sellers, as the sale of shares is often taxed at a lower rate. Buyers may also be eligible for certain tax deductions and credits that are not available in asset sales. These tax considerations can have a significant impact on the overall financial outcome of the transaction.

Advantages of Asset Sales for Dental Practices

Asset sales offer several advantages for dental practice owners looking to sell their practice. One of the most notable benefits is the ability to selectively transfer assets. This means sellers can choose which assets to sell and which to retain, giving them greater control over the transaction. This flexibility can be particularly useful for sellers who wish to continue practicing or retain certain assets for future use. Another advantage of asset sales is the potential for a smoother transition. Since buyers can gradually integrate acquired assets into their existing practice, there is less disruption to their operations. Sellers can also provide training and support for the specific assets being transferred, ensuring a seamless handover. This approach can be especially beneficial when transferring patient lists and ensuring continuity of care. The ability to facilitate a smooth transition can enhance the overall success of the sale and contribute to positive outcomes for both parties. Asset sales also allow buyers to avoid inheriting the seller's liabilities. By selectively purchasing assets, buyers can avoid taking on any existing debts or legal issues associated with the practice. This can be a significant advantage, especially if the seller’s practice has any outstanding loans or pending legal matters. For sellers, this means they can negotiate the sale of assets they no longer need while retaining control over the rest of the practice. Overall, asset sales offer a practical and flexible solution for both buyers and sellers in the dental industry.

Advantages of Stock Sales for Dental Practices

Stock sales offer several advantages that make them an attractive option for dental practice owners looking to sell their practice. One of the key benefits is the simplicity of the transaction. Since the buyer is acquiring the entire entity, there is no need to itemize individual assets or negotiate separate agreements for each asset. This can streamline the sale process and reduce the time and effort required to complete the transaction. For sellers, this means they can quickly and efficiently transfer ownership of their practice without the need for extensive documentation and negotiations. Another advantage of stock sales is the potential for significant tax benefits. Because the buyer is acquiring the entire entity, they may be eligible for certain tax deductions and credits that are not available in asset sales. For sellers, stock sales can result in lower capital gains taxes, as the sale of shares is typically taxed at a lower rate than the sale of individual assets. These tax advantages can make stock sales an appealing option for dental practice owners looking to maximize their financial gains. Stock sales can also provide a more straightforward transfer of ownership. Since the buyer is acquiring the entire entity, there is no need to reestablish contracts or renegotiate agreements with third parties. This can simplify the transition process and ensure continuity for patients, employees, and other stakeholders. Sellers can benefit from the ease of transferring ownership and the potential for a quicker, more efficient sale. Overall, stock sales offer a streamlined and advantageous solution for both buyers and sellers in the dental industry.

Financial Implications of Asset vs. Stock Sales

The financial implications of asset vs. stock sales are a critical consideration for dental practice owners looking to sell their practice. One of the main differences is the impact on tax liabilities. Asset sales typically result in higher tax liabilities for sellers, as the sale of individual assets can be subject to ordinary income tax rates. However, buyers may benefit from depreciation deductions and other tax advantages associated with the acquired assets. Stock sales, on the other hand, can offer lower capital gains taxes for sellers, as the sale of shares is often taxed at a lower rate. Another financial consideration is the valuation of the practice. In asset sales, each asset must be individually valued, which can be time-consuming and complex. Buyers may need to conduct thorough due diligence to assess the value of each asset and negotiate appropriate terms. In contrast, stock sales involve the valuation of the entire entity, which can simplify the process and provide a clearer picture of the practice's overall worth. Sellers may benefit from a more straightforward valuation process and the potential for a higher sale price. Financing options are also an important factor to consider. Asset sales may require buyers to secure financing for individual assets, which can complicate the transaction and limit their ability to acquire the practice. Stock sales, on the other hand, may offer more flexible financing options, as buyers can leverage the entire entity to secure funding. This can make it easier for buyers to finance the purchase and ensure a smoother transaction. Sellers may benefit from a quicker and more efficient sale process and the potential for higher financial gains.

Legal Considerations in Dental Sales Transactions

Legal considerations play a crucial role in dental sales transactions, whether it involves asset sales or stock sales. One of the main legal considerations is the transfer of ownership. In asset sales, the transfer of individual assets requires separate agreements and documentation for each asset. This can be time-consuming and complex, requiring thorough due diligence and legal expertise. Buyers must ensure that all assets are properly transferred and that there are no outstanding legal issues associated with the practice. In stock sales, the transfer of ownership involves the sale of shares in the corporation, which can simplify the process. However, buyers must assume responsibility for all existing contracts, liabilities, and legal obligations associated with the practice. This requires thorough due diligence to ensure that the buyer is fully aware of what they are inheriting. Sellers must disclose all liabilities and ensure that the transaction is conducted in compliance with legal requirements. Another important legal consideration is the negotiation of terms. In asset sales, each asset must be individually negotiated, which can be time-consuming and complex. Buyers and sellers must agree on the terms of the sale, including the price, conditions, and warranties for each asset. In stock sales, the negotiation process can be simpler, as it involves the sale of shares rather than individual assets. However, buyers must ensure that the terms of the sale are fair and that they fully understand their legal obligations. How to Decide Which Sale Type is Right for Your Practice Deciding which sale type is right for your dental practice requires careful consideration of various factors. One of the main considerations is the scope of the transaction. If you are looking to selectively transfer assets and avoid inheriting liabilities, an asset sale may be the better option. This allows you to choose which assets to sell and which to retain, giving you greater control over the transaction. However, if you are looking for a simpler and more straightforward transfer of ownership, a stock sale may be more suitable. Another important factor to consider is the financial implications of the sale. Asset sales typically result in higher tax liabilities for sellers, as the sale of individual assets can be subject to ordinary income tax rates. However, buyers may benefit from depreciation deductions and other tax advantages associated with the acquired assets. Stock sales, on the other hand, can offer lower capital gains taxes for sellers, as the sale of shares is often taxed at a lower rate. Buyers may also be eligible for certain tax deductions and credits that are not available in asset sales. Legal considerations are also crucial in deciding which sale type is right for your practice. In asset sales, the transfer of individual assets requires separate agreements and documentation for each asset, which can be time-consuming and complex. Buyers must ensure that all assets are properly transferred and that there are no outstanding legal issues associated with the practice. In stock sales, the transfer of ownership involves the sale of shares in the corporation, which can simplify the process. However, buyers must assume responsibility for all existing contracts, liabilities, and legal obligations associated with the practice.

Conclusion: Making an Informed Decision for Your Dental Practice

Deciding between asset sales and stock sales for your dental practice is a significant decision that requires careful consideration of various factors. Each approach offers unique advantages and challenges that can impact the sale process and your financial future. Asset sales allow for a smoother transition of individual components like equipment and patient lists, while stock sales may offer a simpler transfer of ownership with potential tax benefits. Understanding the key differences between these approaches is crucial for making an informed decision that aligns with your personal and professional aspirations. When evaluating asset sales, consider the flexibility of selectively transferring assets and the potential for a smoother transition. This approach can allow buyers to avoid inheriting liabilities and ensure continuity of care for patients. On the other hand, stock sales offer simplicity and potential tax advantages, making them an attractive option for sellers looking to quickly and efficiently transfer ownership. Buyers can benefit from a more straightforward transaction and the potential for significant financial gains. Ultimately, the decision between asset sales and stock sales depends on your specific goals and circumstances. Carefully weigh the financial implications, legal considerations, and overall impact on your practice to determine which approach best serves your needs. By understanding the pros and cons of each option and considering real-life case studies, you can make a well-informed decision that ensures a successful transition for your dental practice. Whether you're looking to maximize value or ensure seamless continuity, understanding these differences is your key to a successful transition.

Next Steps:

- Get an understanding of value from a software like Dental Practice Connect or a certified appraiser.

- Strengthen your operations and brand visibility.

- Work with a CPA or legal advisor to maximize your tax outcome.

Leslie George

Founder, Dental Practice Connect

Leslie George is a seasoned finance and operations professional with cross-industry experience. Over the past six years, he has dedicated his work to helping dental practices achieve operational excellence. All while building a meaningful, balanced life for his wife and children.

Share

Our Recent Knowledge Base

Explore real-world success stories showcasing innovation, sustainability, and efficiency.